Requesting, tracking, collecting, and chasing lien waivers is a pain in a neck, and it’s a pain for everyone in the construction payment chain. Construction lenders, property developers, general contractors, and subcontractors are all juggling this intricate and misunderstood process.

And the worst part? It gets in the way of everyone’s payment on a job.

Cash flow is a problem for virtually everyone in the industry, and payment takes a long, long time. The lien waiver tracking and collection process is a big reason why.

- Do you want to make this process easier and faster?

- Want to better understand why you’re chasing these pesky documents around in the first place?

- Want a simple lien waiver tracking spreadsheet or technology to reduce your headaches?

Then read on. This comprehensive article will explain everything you need to know about requesting, collecting, tracking, and managing lien waivers, and walk you through the best practices that can save you time, headache, and make the job of construction payments faster.

1. Know what you’re looking for when tracking lien waivers

The first step to requesting and tracking lien waivers is simply knowing what you need, and who you need it from.

It’s surprising how much time and energy is spent chasing around unneeded lien waiver documents! Since the lien waiver concept is so complicated, there is a ton of misinformation and misunderstanding out there. It’s common for stakeholders to take a “shotgun approach” to lien waiver compliance and go overboard with requirements.

As we’ll explore in this article, the shotgun approach can do more harm than good for two reasons. First, it makes the process more complicated, time-consuming, and ripe for error. And second, the “include everything under the sun” approach can actually run afoul of state restrictions, rendering worthless all the work collecting these documents.

The biggest misconception about collecting lien waivers

The biggest misconception about lien waivers breaks down into these 2 false beliefs:

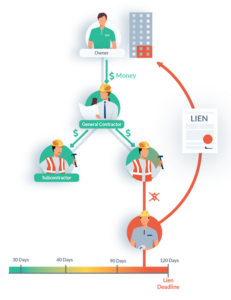

False Belief #1: If you get a lien waiver from a contractor it protects you against lien claims from that contractor’s subs/vendors/suppliers.

The graphic on the right does a nice job of explaining how lien rights actually work, and it can be downright scary. In the graphic’s example, an owner can pay the general contractor (and get a waiver), and a general contractor can pay the subcontractor (and get a waiver)…But, if the subcontractor fails to pay the supplier, the supplier can file a lien and make the owner pay for the work. The lien waivers collected from the general contractors and subcontractors are absolutely useless against the supplier’s claim!

This false belief is dangerous because it leads companies into breaking their back in collecting lien waivers from some people on the job (i.e. those they know) thinking the waivers will protect them from others on the job (i.e. those they don’t know).

False Belief #2: You need to collect lien waivers from contractors/subs/suppliers that you hire.

Lots of time and energy goes into tracking and collecting lien waivers from companies that you hire directly. But think about it — you don’t need a lien waiver from someone you are directly paying. As we explored in more detail in our Ultimate Guide to Lien Waivers, lien waivers are simply a “receipt” that payment has been made. If you are actually making the payment to a contractor or supplier directly (including through a joint check), then it’s simply unnecessary to get a lien waiver from that party. You don’t need the lien waiver receipt to prove you paid them…you have direct proof that you paid them, and that will protect you against them filing a lien.

Instead, you need proof/receipts from the people that they paid. And as explored with the above False Belief #1, the lien waiver from the person you paid directly is worthless in helping protect you against the people that they are supposed to pay. You need those lien waivers directly.

There may be a practical exception to this. If some other stakeholder (i.e. lender) is requiring lien waivers from everyone you hired, then you’ll need to collect them. This is important to the lender because of the same principle, though. Your lien waiver to the lender will not help the lender against lien claims made by people who you are supposed to pay.

Lenders: The lien waivers you need to track on the job

Construction lenders have, perhaps, the most difficult lien waiver collection job. This is because they sit at the very top of the project pyramid and are at risk to absolutely everyone throughout the chain. Lenders need to drill deep, deep, deep through the payment chain to make sure everyone is paid, and that they have waivers in-hand for everyone. Frankly, this is a really complex task.

Here is a breakdown of which lien waivers lenders need from general contractors:

- Lenders do need a waiver from the general contractor (unless they pay the GC directly);

- Lenders do need waivers from all of the subcontractors hired by the GC;

- Lenders do need waivers from all the subs/vendors hired by any and all subs.

General Contractors: What you need to collect from subs

General contractors usually get a lot of pressure to collect, track, and organize the lien waivers on a job. The property developer and construction lender essentially delegate their complex and difficult lien waiver tracking tasks to the general contractor. This is even reflected in the contract documents, which very commonly obligate the general contractor to keep the property “free and clear of liens.”

This is one major reason why mechanic lien claims are so effective at getting companies quickly paid — they create contractual problems for the general contractor, affect payment bonds and bonding capacity, and more.

If you’re a general contractor, you need to keep track of everyone on the job, and you probably need to collect lien waivers from them all. With every payment.

Here is a breakdown of the lien waivers general contractors need to collect on a job:

- GCs may need a waiver from all subs hired on the job (if lender/owner wants it);

- GCs do need waivers from all the subs/vendors hired by any and all subs.

Subcontractors: The waivers you need to collect from subs & vendors

Most subcontractors won’t have many layers of job participants to track, but they actually have a pretty complicated lien waiver tracking and collecting task because the timing with how they pay and interact with supplier and vendors is wonky.

Lenders, property developers, general contractors, and subcontractors all operate on a pretty structured monthly payment cycle. Applications for payment are typically due to a general contractor monthly, on a specific day of the month, and all lien waivers are expected at that time. This schedule mostly works, and helps everyone keep track of all the work done and amounts due.

Subcontractors and suppliers, on the other hand, do not operate on this monthly payment cycle. Instead, subcontractors usually order materials and equipment through an open account with a vendor. Vendors, suppliers, and equipment rental companies are constantly sending the subcontractors invoices. The invoices are not always segmented by job and the invoices are not always accompanied by a lien waiver.

Lining up the monthly payment/draw schedule with the speed of materials & equipment billing is no easy task. Take a look at how one subcontractor, Erin McAllister, the CFO at Central Concrete of N.C., Inc., described the problem in the CFMA (Construction Financial Management Association) Connection Café forum:

Every GC has their own lien waiver form and their own special snowflake requirements. They want lower tier waivers from every supplier on the job. Tracking multiple concurrent projects with multiple (some same and some different) vendors is a serious pain.

Once I receive a monthly payment from a GC, I make the appropriate vendor payments; then I have to give them time to process the payments; then I email the lien waivers with the specific special instructions for that particular GC and project; wait for waivers to come back (send reminders as needed); forward waivers to GC; request revised waivers from all vendors who haven’t filled them out perfectly or to meet the GC’s whimsically changing requirements; wait for revised waivers (sending reminders, etc.); forward to GC; wait for GC to process payment (or decide they need something more/different); email GC asking why payment hasn’t been processed, etc., etc. ad nauseum for EVERY project.

This is a major headache, of course. Here is a breakdown of the lien waivers subcontractors need to collect on a job:

- Subs may need a waiver from all the subs/vendors they hired on the job (if the GC wants it);

- Subs do need waivers from all the subs/vendors hired by any and all of their subs.

2. Have clear, simple lien waiver forms

The second step to making requesting & tracking lien waivers easier, faster, and less stressful? Make the lien waiver forms simple!

Many in construction make the lien waiver tracking process more difficult than it needs to be with convoluted form requirements. This has almost zero positive consequences and at least two negative consequences, which are that:

- It slows things down. Everyone on the job is running their own businesses, and when they have to chase down your specific “snowflake” requirements, it slows down the entire process and makes everything more difficult; and

- It can actually make your paper worthless. As we’ll explore in the below, many states regulate the contents of a lien waiver form, and even when the form is not regulated, the “waiver” of lien rights typically is, and you can very easily create legal problems for yourself with bespoke lien waiver language.

In summary, the simpler you make the lien waiver forms you’re trying to collect, the easier it will be to collect.

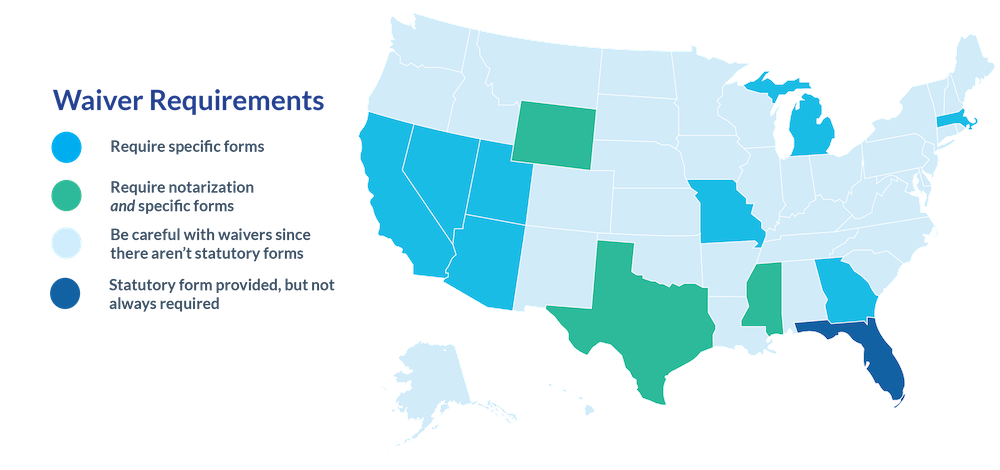

Follow your State’s requirements

Some states strictly regulate the contents of a lien waiver form. You want to follow these requirements. Most contractors and suppliers are familiar with the state’s lien waiver form, and therefore, collecting and providing the standard waivers will be easy for them. Further, if you don’t follow the requirements, you may wind up with invalid waivers, defeating the entire purpose of your efforts.

12 states have explicit and specific lien waiver form requirements. We wrote about these requirements in more detail here: 12 States with Required Lien Waiver Forms. Here is a map that visually summarizes the lien waiver form requirements across the United States:

If you’re doing business across state lines, juggling between the different forms adds another layer of complexity to your process. However, it’s a best practice to do the juggling. Don’t try to create a “one size fits all” form because you’ll likely create more headaches than you solve. Instead, stick to the simple, well-known, and trusted state forms.

And in all cases, don’t overreach. You can find some simple and effective lien waiver forms used on thousands of projects here.

Don’t overreach with legal terms

Contractors commonly stuff their lien waiver forms with legal provisions and protections in an attempt to protect themselves against every risk that they (or their lawyers) can think of. This is a common practice, and it’s common to get advice from actual attorneys to do this. In my opinion, as someone who has practiced construction law and presided over the exchange of hundreds of thousands of lien waivers and studied this subject for years….this is bad, bad advice.

Why is this bad advice?

First, it’s the wrong thing to do and the wrong way to behave. You already have a contract you negotiated with your project partners…the moment of payment is not the right time to strong-arm your partner into new legal obligations.

Second, adding new legal obligations within a lien waiver (or even notarizing it) may invalidate the waiver document completely. In states with required forms especially, but also states without explicit form requirements still have public policy protections against having contractors and suppliers unfairly waiving their lien rights.

Third, this makes your lien waiver tracking and collection process more difficult and more stressful. You’ll constantly be in a tug-of-war with the other stakeholders on the job about lien waiver language. All of this tugging and pulling will create a thousand headaches for you, and the likelihood of your fancy, jam-packed legal ninja move actually finding its way into a court dispute and helping is slim to none.

It may be extremely tempting to use the lien waiver document to put yourself in a better legal position. You may even be advised to do so. But, this is bad advice. It will slow down and complicate your waiver tracking process, it may be illegal, and ultimately, it’s the wrong way to behave.

3. Curate & maintain a list of stakeholders on the job

The third step to a super smooth and easy lien waiver tracking process is to diligently curate and maintain a list of all stakeholders on your jobs.

This can be daunting, especially if you’re on a big project. But it is essential, and if done well, is the most impactful way to make your process a breeze. It’s much better and easier to spend your process energy on this, as opposed to cramming and chasing information around with every payment application.

And the good news is that there are some best practices you can employ here.

If you follow these best practices, you’ll be smooth sailing.

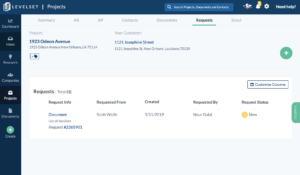

Get a tool that can track layers of stakeholders

Don’t skip over this! This can turn out to be the most important part of this entire article.

Managing a construction project is unique to managing other types of projects, and that’s why there’s a variety of bespoke software products out there to help companies manage construction projects. The construction payment process is even more unique. Unlike other elements of managing a construction job, when it comes to payment, companies need to keep track of the entire construction payment chain.

Most software products — even construction project management tools — do not competently help you track the entire chain. You may be able to use these tools to keep track of your customer and your vendors, but can you cleanly see all the way up and down the chain? A list of contacts on your job is nice and all, but it’s not going to help you when you need to get a lien waiver from Supplier ABC, and you don’t know who hired Supplier ABC.

It’s incredibly common for accountants or project managers to be tracking job participants in Excel or on a physical job board. Doing lien waiver tracking in Excel is just plain messy…and take a look at this physical job board to the left as an example of how this might be handled at some companies. Yikes!!

This is a really critical component of a good lien waiver tracking process.

You need to be able to clearly see who is on the job and where they fit into the contracting chain. Having a nice, clean databasing system that can keep track of all the layers of your job is going to make your job a lot easier.

Though you should use some type of system and not a spreadsheet to do lien waiver tracking and collection, you can find an example spreadsheet for lien waiver tracking here.

Fall in love with preliminary notices — & always request them

Preliminary notices make your job easier.

All of the work and best practices that follow in the next two sections would simply not even exist if you received preliminary notices all the time. Accordingly, every time you don’t receive a preliminary, you have more work to do. It would be excellent if every contractor and vendor on your jobs sent you a preliminary notice.

Get more details about this in the blog post, “Top 5 Reasons You Should Love Receiving Preliminary Notices.” To make your lien waiver tracking process easier, here are your preliminary notice best practices:

- Have a method to track them and record the information within: Collecting preliminary notices all in one place can be complicated, especially if you have multiple locations and receive preliminary notices all over the place. Software can help here, and the second item below can help here as well. Nevertheless, you want to get all of your notices in one place and you want to get the information off the notice and into your lien waiver tracking systems/spreadsheet. For more help here, check out this question & answer from a construction attorney in our Ask An Expert center: I received a preliminary notice, what do I do next?

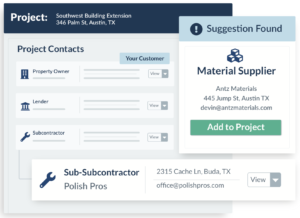

- Request preliminary notices from your subcontractors: Since preliminary notices are so helpful, it’s a best practice to always request preliminary notices from your subcontractors and suppliers. Ask them to provide these notices. Send them requests for notices (software like Levelset’s can help with this).

- Fire off Vendor Requests to everyone who appears in a preliminary notice: Finally, every time you receive a preliminary notice, make note about every party identified in the notice…and then immediately send those parties a request for their vendors. This device is discussed in the next section.

Follow best practices when requesting subs & vendors

You need to know everyone on your job. The best way to figure that out is to always, always, always request this information from everyone you do know. It is a best practice to literally fire off a request for this information to everyone you know, immediately when you know them.

Having a system to let you fire off these requests (and track them) in seconds will make you a lot more likely to diligently run this process. But, if you have such a system set up, it will make this one of your most valuable information-gathering devices.

In some states, this is your legal right, and you can employ legal devices to collect this information. Some states, for example, let you request and collect “sworn statements” to identify people on the job. If you follow the process correctly, this can help you with the lien waiver collection process directly because you won’t be required to get lien waivers from people who aren’t identified…and you won’t be exposed to liens from them!!

When a state’s law doesn’t have a specific instrument for this (i.e. sworn statement), you can still put yourself in a really good legal position by making these requests less formally.

Do job & stakeholder research early

The final best practice in curating and maintaining a list of all stakeholders on the job is to do job research early! You don’t want to be scrambling around trying to figure out who is on the job when the payment clock is ticking. That’s too much stress and pressure, and it always creates delays. When you’re working on getting a payment application submitted, you want all of these stakeholder blanks to be filled in.

The above best practices help you fill-in the blanks about who is on the job and who you need to get lien waivers from. However, even when you follow these best practices, you may still not know everything. You still need to do a little research to make your stakeholder list (i.e. or lien waiver tracking sheet) complete.

What can you do?

- Make phone calls

- Send emails

- Search online databases

- Pay services to do research for you

- Use tools like Levelset, which can automatically fill in your blanks

4. Create a consistent & easy lien waiver tracking process

The fourth step to making lien waiver tracking & collection easy is to use a simple and consistent process. You can do this by following a few best practices.

Post your forms & process on your website

It’s so surprising that contractors don’t do this more often. It’s simple, and it makes so much sense. Your lien waiver form and process is not a trade secret. And certainly, you aren’t a fan of playing the telephone and email game with every job stakeholder.

Make this easy.

Lay out your lien waiver collection process and forms publically. Put it on your website. Give subcontractors and suppliers a simple place where they can easily find this information. Even better, provide subs & suppliers with a way to submit the lien waiver directly to you.

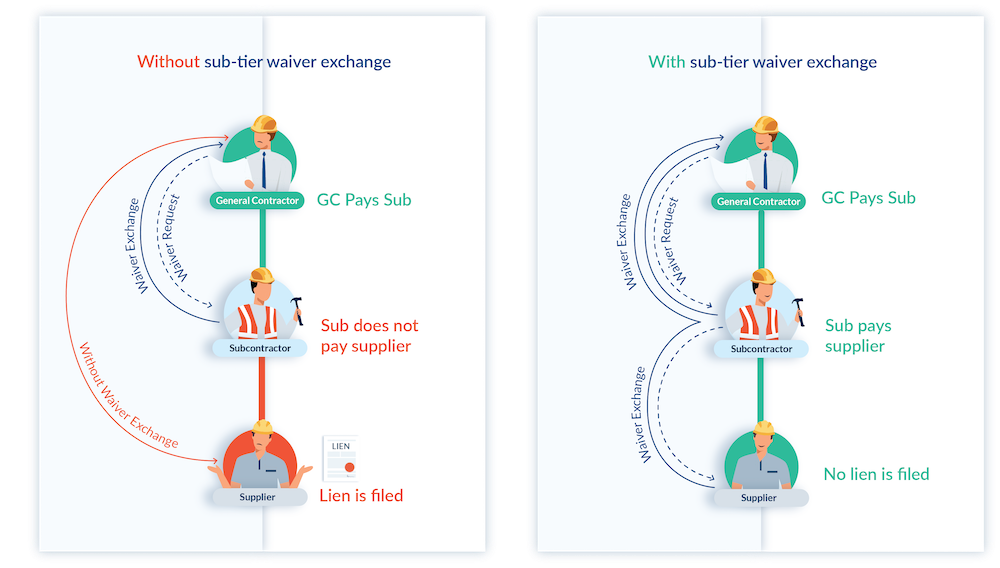

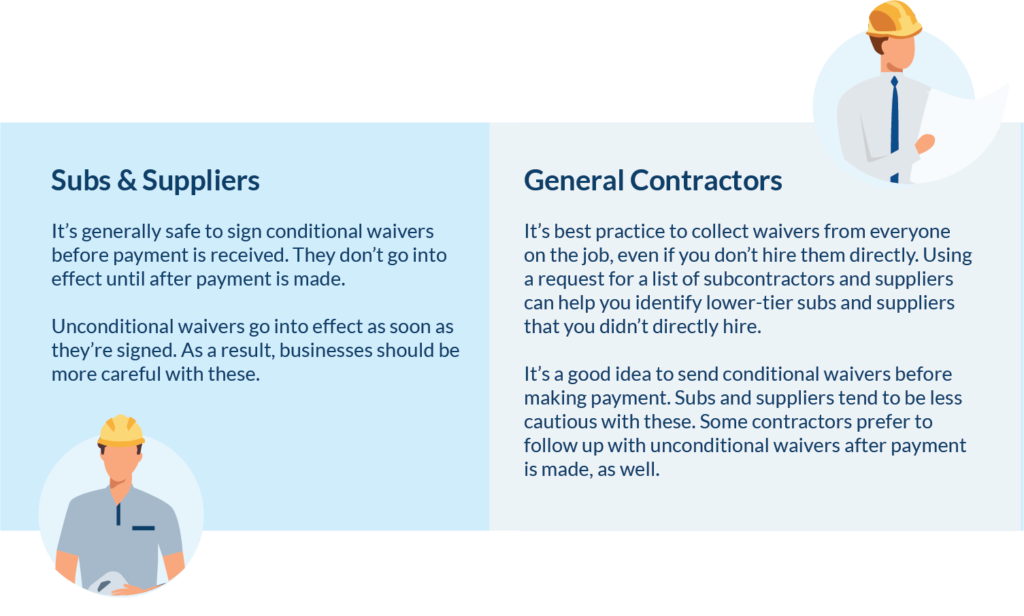

Be fair & simple with the conditional/unconditional waiver dance

This is an area where a lot of people get tripped up.

The differences between conditional and unconditional lien waivers have been well documented. Check out this 1-page downloadable guide and chart on the 4 Types of Lien Waivers.

The “catch-22” in timing the exchange of money for lien waiver has also been well documented. For example, check out our in-depth article digging into this problem, Unconditional Lien Waivers vs Conditional Lien Waivers and the Construction Payment Catch 22.

And here is a very, very high-level overview of how different stakeholders look at these different lien waiver types differently:

So, how can you create a simple process that is fair and that takes care of business?

Getting a conditional waiver from people you are paying directly

There was a great discussion about lien waiver tracking in the CFMA’s Connection Café. In the discussion, a controller for a general contracting company (Debbie Clark of Lenzi Incorporated) went into her process to get “conditional” waivers with every pay application, and then following that up by requiring “unconditional waivers” after payment has been received. Here is how she explained her process:

The only solution to tracking is this: When you receive the Sub’s invoice there should be a Conditional Waiver attached. If it is not attached, we won’t process the invoice.

When payment is sent to the Sub we send the Unconditional Waiver with the check. However….. if they Unconditional Waiver does not come back and we receive another invoice. We notify the sub that until the unconditional waiver is received from the previous payment, no other invoices will be processed or payments made.

It usually only takes one (maybe two) times to do this and they get the point. This is the only way to get those waivers back so payments to us are not help up.

The first part of Debbie’s process makes sense and is a great best practice, but the second part is an unnecessary hassle.

The first part is to collect conditional lien waivers with every pay application. This is easy, easy, easy to do, and subcontractors can very easily be put into this habit. It’s something that subcontractors should be doing anyway, as we explore in Why you should send a lien waiver with every invoice.

The second part is to require the subcontractor to follow up with an “unconditional waiver” after they receive payment. You can go through this process if you want, but it is simply unnecessary. If you make payment to the subcontractor and have a “conditional” waiver in hand, then your job is 100% complete. The “conditional” waiver + evidence of payment is all you need. It is the very same thing as an “unconditional” waiver from that sub. There is no difference at all. Not a single difference. Any attempt to get this second waiver is just superfluous work, and you shouldn’t do it.

You do need unconditional waivers from people you don’t pay

Here. Is. Your. Problem.

To have a great lien waiver tracking system, you’ll want to solve the problems you actually have, not the problems you don’t have. Debbie’s process is solving problems that she doesn’t have. She doesn’t even really need a conditional waiver from the people she is paying…she already has evidence that she is paying them!

The problem that Debbie (and most contractors) actually have is that they need unconditional lien waivers from the people they are not paying.

- Conditional Waivers & Joint Checks: This is the most common use of using joint checks. Issuing a joint check to your contractor (i.e. the one you are paying directly) and all of that contractor’s subs and vendors (i.e. the ones you are not paying) is a great system and process. This allows you to collect conditional lien waivers from the stakeholders and not really worry about unconditional. It solves your problem.

- Conditional Waivers & Notify, Notify, Notify: Another option for you is to collect conditional waivers for all the stakeholders and to have a great system of notifying everyone about payments exactly when you’re making them. If you notify a sub-tier supplier that payment is being made on Day X, it significantly reduces the chances that a subcontractor will stiff that sub-tier supplier.

- Require Unconditional Waivers: Finally, you can require unconditional waivers from sub-tiers, but you need to be really careful. You can’t just require it for the sake of requiring it. To be safe, you need to make sure that the sub-tiers are actually already paid.

You’ll note that #1, #2, and #3 options all require that you know who the lower tier stakeholders are. This re-emphasizes the importance of our Step 3: curating and maintaining a list of job stakeholders.

5. Ditch the Paper & Use Digital Lien Waiver Tracking System

Managing the lien waiver tracking process manually is…manual. The paperwork will quickly get messy. Errors happen. And errors can be quite expensive.

The people you work with are spending a ton of time behind their computer screen or mobile device. Getting you the lien waiver paper is actually harder and slower for them. Getting them to fill it out with some PDF reader is complicated and slows things down. It makes the form come out funny. It leaves room for error. Furthermore, you’ll have so many documents and emails flying back and forth, you’ll lose track.

Did you know you can electronically sign lien waivers? Because you can!

The fifth and final best practice for lien waiver tracking is to use a system. It will help you remain sane. It will help you sleep at night. And it’s the best practice that will help you consistently implement all the other best practices.

Make it super simple & fast for subs & vendors to submit waivers to you

Digital lien waiver tracking systems help you do something really, really important. They help you make it easier on others to get lien waivers to you.

If you step back and look at your lien waiver tracking problem, a lot of it relies on others. The only way you’ll make your life easier is if you make it easier for all the other stakeholders to get lien waivers to you. These other stakeholders have other jobs, other contractors they are dealing with, and they have just as many business headaches as you do. You need to be the easiest and smoothest contractor to work with. If you are, you’ll always be at the top of their list.

Digital lien waiver tracking and collection systems make it easy for your contractors and suppliers to get a lien waiver in your hands.

Have A Single Place For Tracking Lien Waivers & Stakeholders

The above section discusses how a lien waiver tracking system helps you by helping others…but it also helps you!

As you can see in this best practices guide to tracking and collecting lien waivers, there is a lot for you to do. You need to use the right forms, keep track of all the stakeholders, send stakeholders requests for more information, do stakeholder research, manage the in-take of preliminary notices, implement a smooth and easy process for others to get waivers to you, etc. In addition to this, you need a dashboard to see what you have and what you still need.

A digital system is really the only solution to this.

Top 5 things NOT do when collecting & tracking lien waivers

Congratulations! You have all the best practices you need to solve your lien waiver tracking headaches. Now let’s go through some common lien waiver pitfalls. Perhaps this is the last best practice — to avoid all of the common mistakes that you shouldn’t do when managing lien waivers.

Asking for notarized lien waivers

It’s a super common practice for folks to require lien waivers be notarized. Lien waivers rarely require notarization, and the benefits of getting a lien waiver notarized are minuscule. You’ll be extremely hard-pressed to find any example of when notarization on a lien waiver made any difference to anything. It’s almost always absolutely non-sense. Asking people to notarize your lien waivers is just wasting time, unnecessarily complicating your process, and may even be illegal! We explore this in more detail (including identifying the only state that requires notarization) in Do Lien Waivers Need To Be Notarized?

Creating waivers for $0/$10/some random amount

This is something that happens everywhere, but is an especially common practice in Florida, as we explored in the Common Mistakes with Florida Lien Waiver & How To Avoid Them.

This is a bizarre practice that contractors use because it appears to simplify their process. After all, instead of tracking lien waivers more specifically, can we just get the same $0 form signed by everyone and cover all of our bases?

Unfortunately, no. The thing about the lien waiver process is that it is quite complicated. You need a process to handle the complications, and you can’t short cut this by just using a hacked solution like the $0 waiver. That, in fact, is legally dangerous. You might as well not collect waivers at all.

Collecting lien waivers too early

Another no-no is to try and collect your lien waivers super early. The most extreme version of this is asking for a lien waiver within the contract itself! After all, can’t you just get everyone to waive their lien rights at the start of the job and not worry about all this stuff? The answer is that you cannot.

Almost every state makes this (i.e. waiving lien rights in a contract) explicitly illegal, and some states go further, making it illegal to ask for a waiver at anytime before an actual payment is made. Take a look at our 50-State Overview of Prohibitions of Waiving Lien Rights Early. Once again…no shortcuts!

Not collecting from everyone/Only collecting from those who sent a preliminary notice

One common misunderstanding is that you only need to collect lien waivers from contractors and suppliers who send preliminary notices. This might be true some of the times, but it is never true all of the time!

As such, it’s a dangerous practice, and certainly not a “best practice.” For this to work it needs to be lock-step with the preliminary notice requirements in your state. The state-by-state preliminary notice requirements are pretty complicated, and they contain tons of exceptions and nuances. It’s easy to make mistakes. Super easy.

Not having someone responsible for lien waiver tracking

Finally, another common mistake is not having someone in your organization that is responsible for the lien waiver collection & tracking process.

When it comes down to it, this is a really, really important task for two reasons. First, if not done well, it carries a lot of risk. Second, if not done well and fast, it slows up payment.

The bottom line on lien waivers

The lien waiver process is complicated and there are no shortcuts. But, following best practices in tracking lien waivers will give you a process that works. Good lien waiver collection practices will significantly reduce your risks, reduce fires caused by lien filings, and will speed up your payment. And finally, good waiver practices will make people enjoy doing work with you — and want to work with you again.