Taking on new projects or jobs places a large cash burden on construction companies, particularly for subcontractors that are forced to “float” the project costs up front. Since the amount of cash needed will vary from day-to-day (based on the cash flow of the individual project, as well as the company’s overall cash flow from all of their operations), companies both large and small often rely on revolving lines of credit (LOC) as opposed to term loans to source the cash they need to fund the float.

How to Determine Your Company’s “Borrowing Base”

There are 2 big problems that make it difficult for even the most experienced contractor to determine the amount of money they’re going to need to cover the float when taking on a new project:

- Labor and materials costs can change, or more likely, these costs will typically go up over time, especially in a growing economy. This is especially true on projects with extended timelines, or for projects where a significant amount of time passes from the bid stage to the start of the actual work.

- The timing of the incoming cash flow, i.e., the amount of time it takes your customers to pay their invoices can have a huge impact on the amount of cash that it will take to float a project.

So, the reality for most construction business owners or CFOs is that they know they’re going to have to find a source of cash to float their project, but they don’t necessarily know how much cash they’ll need, or when they’ll need it. That’s a tough spot to be in! It makes sense then, to try to mitigate some of the uncertainty by nailing down any details that can be determined ahead of time.

Determining the maximum amount of money that can be borrowed – the credit limit – is one of those important details that can be “locked in” in advance. The way that lenders calculate that figure is to determine a company’s borrowing base.

Construction Defined: Borrowing Base

Borrowing Base is the total amount of collateral against which a lender will lend funds to a business. It presents a maximum cap on how much asset-based debt a business can obtain. Typically, each asset category is discounted by a factor related to the riskiness associated with that asset. Circumstances unique to the construction industry such as retainage/retention, underbillings, and bonded receivables, make for a more complicated borrowing base calculation process.

Construction Finance is Unique

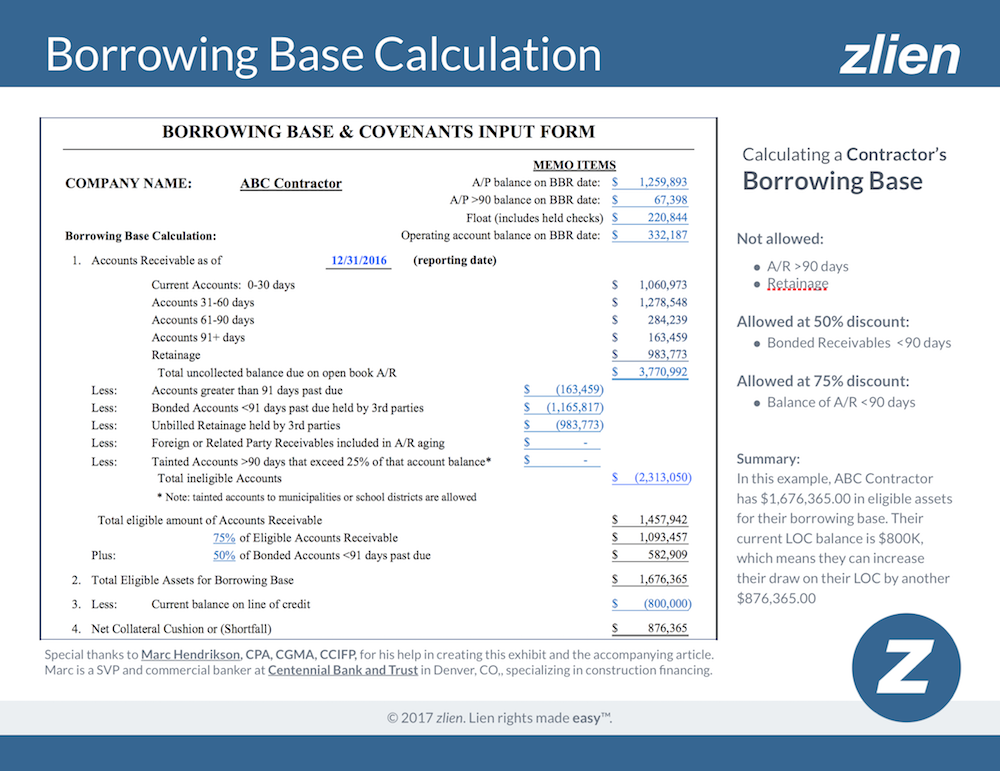

However, since the construction business is so unique, the methodology lenders use to calculate the borrowing base must be tailored to fit the special circumstances common to construction. To find out more about this important topic, we reached out to Marc Hendrikson, CPA, CGMA, CCIFP, a commercial banker from Denver, CO, who specializes in lending to the construction industry. Marc was kind enough to give us a brief overview of how a lending institution might calculate the borrowing base for a fictitious construction company, “ABC Contractor” (see “Borrowing Base Calculation,” below).

The Borrowing Base model shown above is a somewhat generic example that fits for some, but not all, construction companies. In our conversation, Marc added that he is “seeing some banks go to a ‘contractor borrowing base’ that is really unique in that it includes 100% of certain asset categories like cash, underbillings, A/R <90 days (excluding bonded and retention) and then deducts 100% of certain liability categories like A/P, overbillings, and payroll related accruals.”

The method by which a lending institution calculates the borrowing base for their commercial customers is not universal by any means, so you should expect to see different versions of this model – as well as additional requirements, provisions, and covenants – utilized in the marketplace.

Conclusion

Given that the construction industry is unique and all lending institutions will approach this issue differently, we strongly recommend that if you’re going to pursue a commercial LOC for your construction company, your best bet will be to work with a lender that understands the construction business.