The fact that the construction industry has a payment problem comes as no surprise to industry participants. In fact, it takes longer to get paid in the construction business than it does in just about any other industry. First of all, a company has to complete time- and information-intensive payment applications just to get in line for payment. And while construction companies are waiting for those payments, they have to somehow find the cash needed to float all of the upfront costs required to get a project off the ground. And when those payments finally do come in, chances are it’s going to be at razor-thin margins.

Further, the complicated payment structure, high failure rates throughout the payment chain, hidden parties, the risk of liens or double payment, and confusing or complex contractual clauses make efficient payment nearly impossible – whether you’re the party that’s paying the invoices, the party waiting to get paid (or both).

How long does it take for construction businesses to get paid?

In 2018, it took contractors an average of 83 days to get paid, according to an annual PWC report. That number increased from 74 days in 2017.

The complex nature of construction payment and the associated rules and regulations have made it difficult to streamline payment. Subs, sub-subs, and some suppliers or equipment rental companies have had a remarkably challenging time getting paid, or at the very least, getting paid on time. And property owners, GCs, and developers have had significant difficulties in properly controlling payments and controlling their risk of double payment.

One overarching reason is construction’s heavy dependence on credit for work and materials. Many construction companies occupy both sides of the credit fence. That is, they both extend credit to other parties on the project, and provide labor and/or materials on credit themselves. Another hallmark of construction payments is that participants are working on thin margins with significant upfront cash needs. The bottom line is that it’s not unusual for construction companies to wait to make payment until payment is received from the party above.

In fact, some of the legal protections to ensure prompt payment are based on a time period that only begins after the party required to make payment gets paid themselves. When this is coupled with contractual provisions like “pay-when-paid” or even (in some circumstances) “pay-if-paid” clauses – it’s easy to see how payment can end up sluggish. And, the lack of visibility on many projects makes it easy to see how higher-tier parties feel they must be extra-cautious to avoid hidden liens or paying twice.

Everybody can agree on the fact that there are problems with construction payment – but where the agreement ends is what the particular problems actually are.

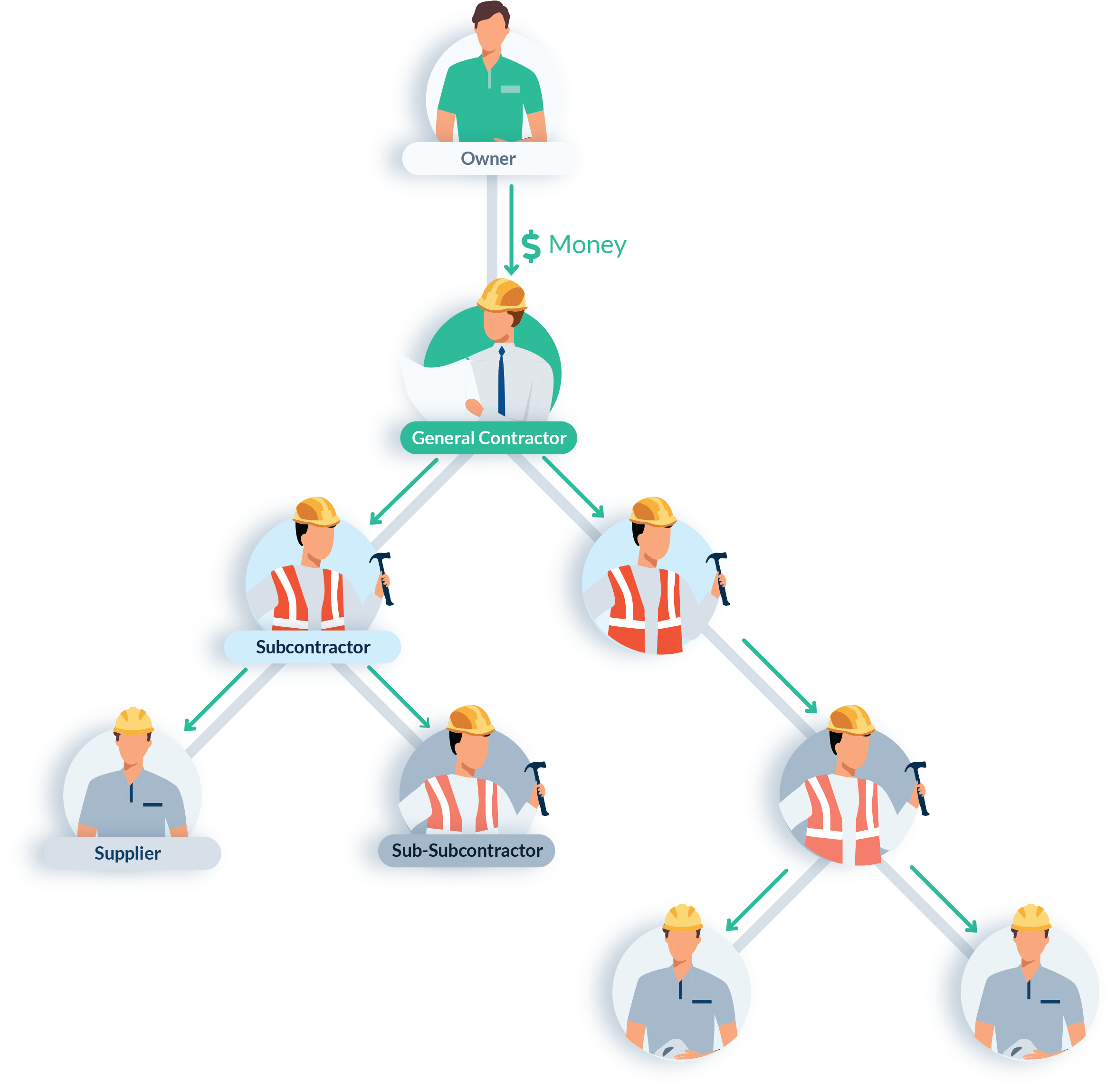

A Top Down Problem: Money Flow

Since general contractors are located near the top of the payment chain, they deal with financial risks that are both similar to and distinct from the subcontractors, sub-subs, and other parties below them.

GCs worry about getting paid just like everybody else. But they are also required to manage payment down the chain, and protect the property/project/owner against the risk of liens and double payment.

The lack of visibility throughout the total project can make this especially difficult. A particular sub-sub’s material supplier may be unknown to the GC — and it’s nearly impossible (and unfair) for GC’s to be tasked with managing payment to make sure that party gets paid. If a participant is unknown to the GC, how can the GC appropriately manage payments?

Read more: How your position on the payment chain affects your rights

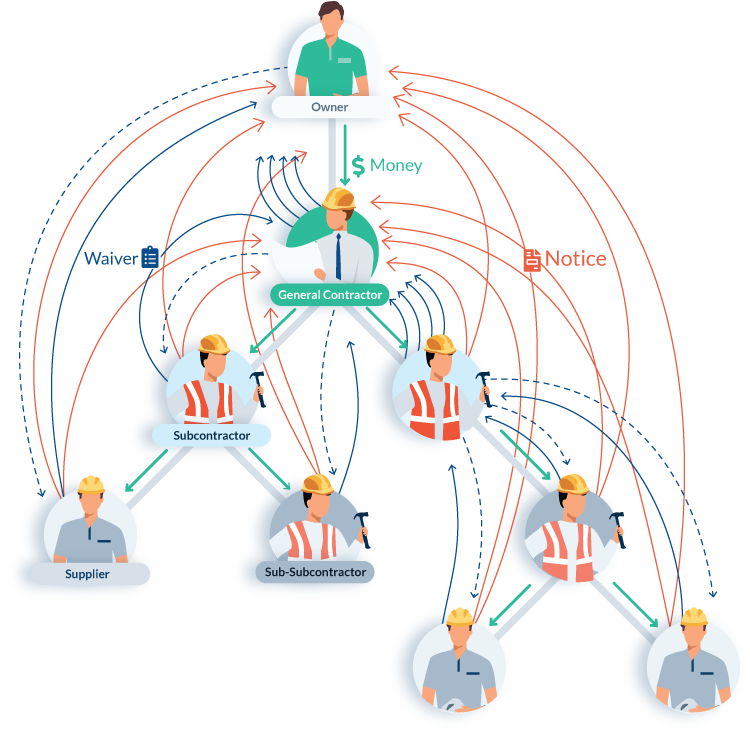

The offshoot of this visibility problem is that GCs and property owners have a reasonable worry regarding the risk of double-payment or stoppages in work triggered by liens, whether or not the usage of lien rights is warranted.

While lower-tier parties have a significant and appropriate objective to get paid – the top-of-chain parties have an equal interest in making sure they are not required to pay more than once for the same work, and protect against knee-jerk lien filings. Accordingly, payment slows down as the top-of-chain parties look to protect themselves, and insulate the project from the risk of liens.

This protection is gained both through contractual risk-shifting provisions (the fairness of which vary and can be disputed) and through the collection of lien waivers in consideration of payment. As many of the contractual risk-shifting provisions, (no-lien clauses, pay-if-paid or pay-when-paid provisions, etc.) have been struck down or weakened when examined by courts, the use of lien waivers as protection and as a mandatory prerequisite to payment has grown. This necessity to collect lien waivers from (virtually) every project participant prior to making each progress payment contributes to the slow payment problem.

A Bottom Up Problem: Document Flow

Payment is slow: There really isn’t much debate about this fact. GCs will agree that payment is not made quickly, but will argue that it is necessary to make sure that “all the boxes are checked” to keep the project going.

Subs will note that even after completing an application for payment with a lot of required information, they still wait a long time for all the waivers to be collected or for the GC to receive a disbursement from the property owner or lender is frustrating.

And the frustration is further compounded when they need to pay their own suppliers on delivery, prior to getting paid themselves.

How to fix construction’s payment problem

As unbelievable as it sounds, construction payment can be fair, streamlined, and efficient. While the fundamental underlying structure of the credit-based process is not likely to go anywhere and will continue to cause occasional problems, many of the underlying issues making construction payment slow can be addressed and resolved.

Read more: The ultimate guide to getting paid in construction

To do so, two of the main problems that are most responsible for the delays must be addressed: Visibility and risk of double payments or liens.

1. Improve sub & supplier visibility

If a fix to the construction payment problem must be based on fairness and transparency, visibility is fundamental. In order for the GC to properly manage payment and protect against the risk of double payment, (both of which are requirements to faster payments) every party on the project should be known. Fortunately, this can be easily accomplished in a way that provides benefits to everybody.

While many GCs understand that receiving preliminary notices from lower-tiered parties is a general aspect of doing business, they should be ecstatic to receive these notices. Preliminary notices are a built-in tracking and management system. If the GC uses construction software, the notice information can be input and the identity, payment status, security status, and lien-waiver status of all parties can be tracked.

The ability to track all project participants allows the upper-tiered parties to manage exposure by providing a made-to-order checklist of parties from whom lien waivers may be required.

2. Send lien waivers all the time, every time

The second step of speeding up construction payment revolves around lien waivers. Lien waivers are routinely requested in consideration for payment, no matter what rung the paying party inhabits.

Know a good way to get things to happen more quickly when you know what’s going to be required? Give that thing up front without being asked. Providing conditional lien waivers with every pay app or every invoice makes good business sense for lower tiered parties – and can knock a step off the payment process (and, accordingly, speed it up).

If a lien waiver is going to be needed – and it will be – provide the lien waiver automatically. Using a conditional lien waiver protects the waiver provider and the paying party: the waiver doesn’t waive lien rights to the extent the party is not paid; but completely waives rights to the extent the payment is made.

Streamlined exchange = faster payment.

It’s undeniable that the construction payment process is complex, convoluted, and messy. However, it can be made fair, manageable, and quicker by understanding the problems and attacking them in a fair and focused way. By focusing on solutions that provide benefits to both the bottom and the top of the payment chain, payment can be sped up in a way that leaves each party satisfied.