Washington Prompt Payment Requirements

- Private Jobs

- Public Jobs

- Top Links

Prime Contractors

Not specified in state statutes

Subcontractors

Not specified in state statutes

Suppliers

Not specified in state statutes

Interest & Fees

Not specified in state statutes

Prime Contractors

For Prime (General) Contractors, payment due within the later of 30 days from invoice or 30 days from receipt of services.

Subcontractors

For Subcontractors, payment due within 10 days of payment received from above.

Suppliers

For Suppliers, payment due within 10 days of payment received from above.

Interest & Fees

Interest at 1% month for prime; interest at statutory rate for subs. Attorneys' fees awarded to prevailing party.

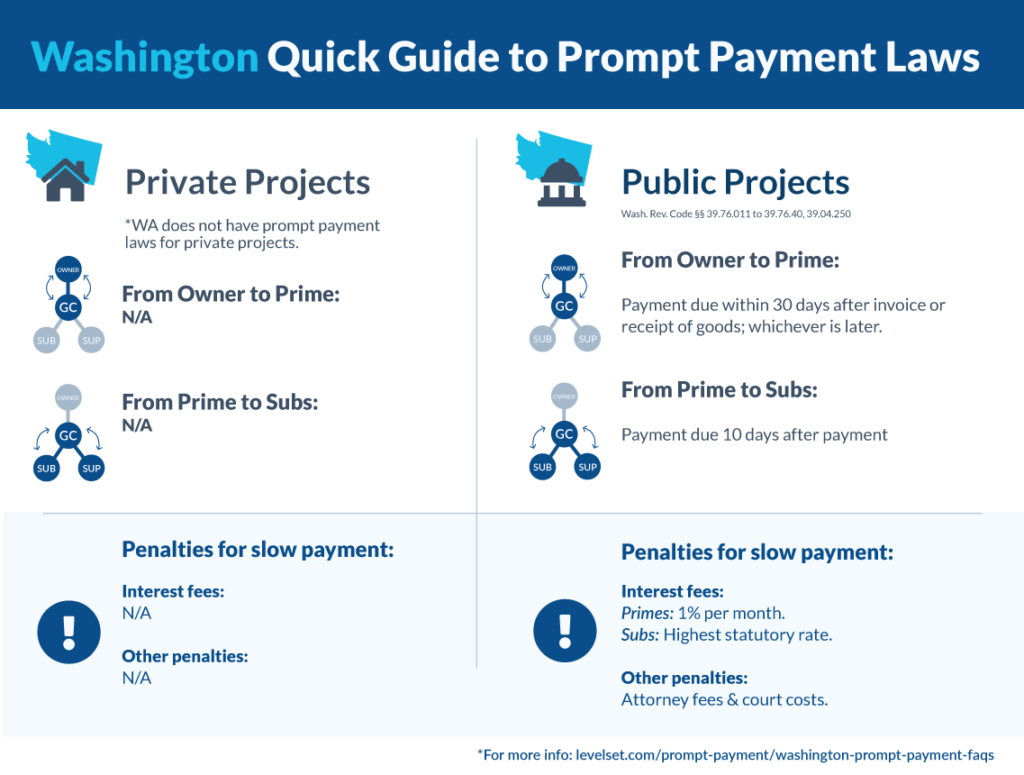

Prompt payment laws are a set of rules that regulate the acceptable amount of time in which payments must be made to contractors and subs. This is to ensure that everyone on a construction project is paid in a timely fashion. These statutes provide a framework for the timing of payments to ensure cash flow and working capital.

Projects Covered by Prompt Payment in Washington

The state of Washington has Prompt Payment statutes that cover only public works projects, found in Wash. Rev. Code §§39.76.010 to 39.76.40, and 39.04.250. These include all construction projects that are commissioned by the state, county, city, town, school district or any other Washington public body.

Deadlines for Payment on Public Projects

The deadline for the public entity to pay the prime contractor on the project is 30 days from either (1) the date the contractor’s invoice was received, or (2) the receipt of the labor or materials; whichever is later. Once the prime contractor receives payment, they are required to pay their subs and suppliers within 10 days.

The public entity and any contractor making payments do have the ability to withhold payments if the performance is unsatisfactory, or if the payment request isn’t in the correct form based on the contract terms. If so, the party withholding payment must notify the party; within 8 days if it’s a public entity, or as soon as practicable for any other party. Once the defective work has been remedied, the public entity must make payment within the same 30-day span, and contractors are required to make payment within 8 days after the work has been remedied.

Penalties for Late Payments on Public Projects

Any payments wrongfully withheld will be subject to interest accruing on the unpaid amount. Late payments from the public entity will accrue interest at a rate of 1% a month, or at least $1 per month. For all other payments, the interest rate is the highest rate of interest permissible under R.C.W. §19.52.025 and is set by the State Treasurer. This rate is published once a month in the Washington State Register, which has been set at 12% a year for some time now. In addition to interest, if the dispute goes to court, the prevailing party will be entitled to reasonable attorney fees.