Illinois Prompt Payment Requirements

- Private Jobs

- Public Jobs

- Top Links

Prime Contractors

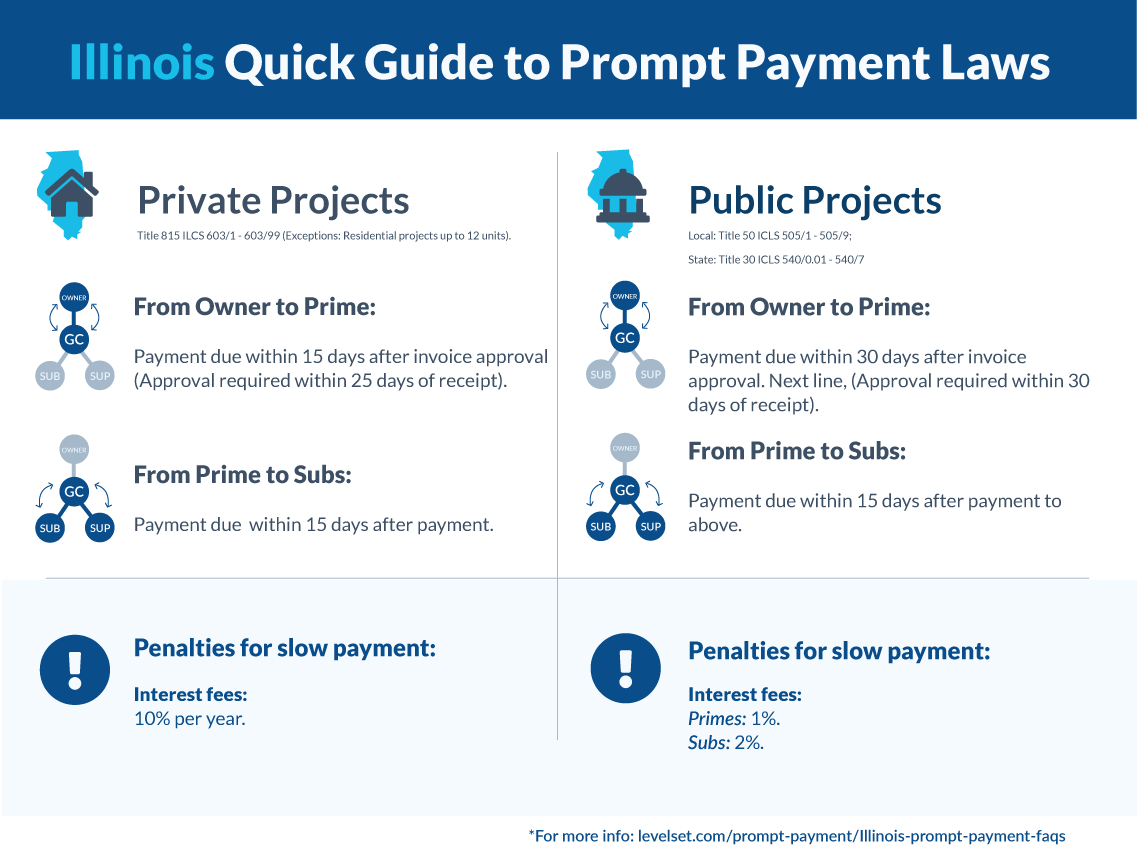

For Prime (General) Contractors, progress payments are due within 15 days of approval of a request for payment. Approval must be done within 25 days, considered automatically approved on 25th day if no written notice detailing withholding of payment delivered.

Subcontractors

For Subcontractors, payment is due within 15 days after payment is received above.

Suppliers

For Suppliers, payment is due within 15 days after payment is received above.

Interest & Fees

Interest at 10% year; no fees provision

Prime Contractors

For Prime (General) Contractors, request for payments must be approved within 30 days. Upon approval, local gov't entities must pay within 30 days, state gov't entities within 60 days.

Subcontractors

For Subcontractors, payment is due within 15 days of after payment is received above.

Suppliers

For Suppliers, payment is due within 15 days of after payment is received above.

Interest & Fees

Interest at 1% per month for Prime; Interest at 2% per month for sub-tiers.

Prompt payment laws are a set of rules that regulate the acceptable amount of time in which payments must be made to contractors and subs. This is to ensure that everyone on a construction project is paid in a timely fashion. These statutes provide a framework for the timing of payments to ensure cash flow and working capital.

Projects Covered by Prompt Payment in Illinois

The state of Illinois regulates prompt payment on both private and public construction projects.

Private Projects

Payment on private construction projects in Illinois is regulated by §815 ILCS 603/1 et seq. These regulations apply to all private projects except for residential projects of 12 or fewer units.

Payment Deadlines for Private Projects

Once a prime contractor has performed in accordance with the contract provisions they will be entitled to payment from the owner within 15 calendar days after the request for payment is approved. The owner must approve payment applications within 25 days of receipt. Upon receipt of payment from the owner, the prime contractor must pay their subcontractors and suppliers within 15 days.

Penalties for Late Payment on Private Projects

If the owner disputes the request, they must send notice within the 25-day approval period, or the request is deemed approved. However, failure to send notice, or otherwise late or wrongfully withheld payments will be subject to interest penalties. Interest will accrue at a rate of 10% a year (0.833%/month). Additionally, contractors and subs who send a notice of nonpayment to the paying party may suspend performance after 7 days until payment is made.

Public Projects

Illinois has two separate sets of statutes that regulate payment on public works projects. These statutes are divided into local public projects 50 ICLS 505/1 et seq., and state public projects found in 30 ICLS 540/0.01 et seq.

Payment Deadlines for Public Projects

When a prime contractor has submitted a proper request for payment the contracting government entity must approve the request within 30 days. Once approved, local gov’t entities must make payment within 30 days, while state gov’t entity’s must make payment within 60 days.

Upon receipt of payment, contractors must make payment to their subs and suppliers within 15 days on local projects, or the earlier of 10 business days or 15 calendar days on state projects. The same deadline applies to payments to sub-subcontractors as well.

Penalties for Late Payment on Public Projects

Any late or wrongfully withheld payments will be subject to interest penalties. For payments to the prime contractor, the interest will accrue at 1% per month. While all other payments will accrue interest at 2% per month until the payment has been made.