Arizona Prompt Payment Requirements

- Private Jobs

- Public Jobs

- Top Links

Prime Contractors

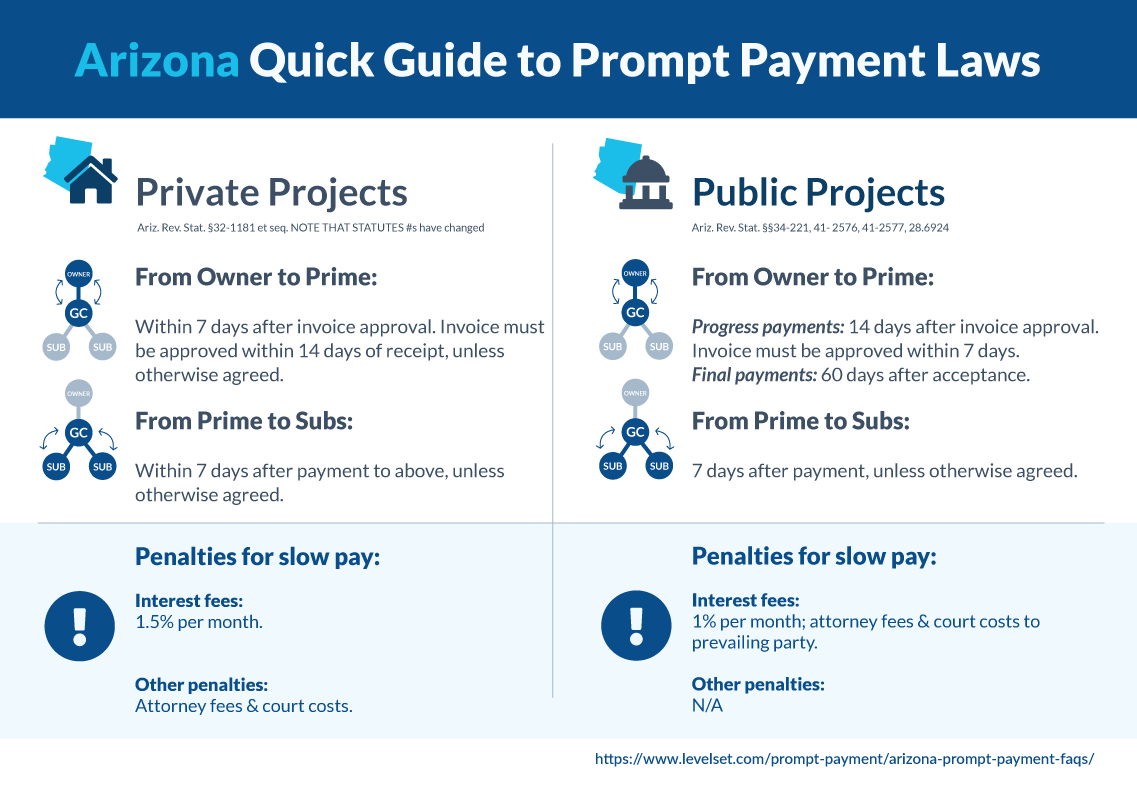

For Prime (General) Contractors, progress payments due within 7 days of invoice approval. (Proper invoice must be approved in 14 days from receipt); unless otherwise agreed.

Subcontractors

For Subcontractors, payment due within 7 days after payment is received above; unless otherwise agreed.

Suppliers

For Suppliers, payment due within 7 days after payment is received above; unless otherwise agreed.

Interest & Fees

Interest at 1.5% a month; attorneys fees awarded to prevailing party in any litigation or arbitration.

Prime Contractors

For Prime (General) Contractors, progress payments due within 14 days after invoice approved (invoice must be approved in 7 days). Final payment due within 60 days of final acceptance of the work as a whole.

Subcontractors

For Subcontractors, payment due within 7 days after payment is received above; unless otherwise agreed. But contract cannot "materially alter" the right to prompt payment.

Suppliers

For Suppliers, payment due within 7 days after payment is received above; unless otherwise agreed. But contract cannot "materially alter" the right to prompt payment.

Interest & Fees

Interest at rate of 1% per month; attorney fees may be awarded to prevailing party.

Prompt payment laws are a set of rules that regulate the acceptable amount of time in which payments must be made to contractors and subs. This is to ensure that everyone on a construction project is paid in a timely fashion. These statutes provide a framework for the timing of payments to ensure cash flow and working capital.

Projects Covered by Prompt Payment in Arizona

The state of Arizona regulates prompt payment on both private and public construction projects.

Private Projects

Private projects in Arizona are governed by Ariz. Rev. Stat. §32-1181 et seq. These deadlines for payment and interest rates will act as default rules, in case the contract doesn’t address the issue.

Payment Deadlines For Private Projects

Once a prime contractor has submitted a valid payment request, the owner will have 14 days from receipt to approve or deny the request. After the pay request is approved, the owner will have 7 days to send payment to the prime contractor. These terms can be modified within the contract between the parties. Upon receipt of payment, prime contractors have 7 days to pay their subs and suppliers. Payments from subs to sub-subcontractors also must be paid within 7 days of receipt of funds.

Penalties For Late Payment On Private Projects

The statute sets forth specific justifiable reasons to withhold payment. However, if none of these apply, any late or wrongfully withheld payments will accrue interest at a rate of 1.5% per month. Also, if the dispute goes to court or arbitration, attorney fees and costs will be awarded to the prevailing party.

Public Projects

Arizona has a separate set of statutes that regulate public works projects. These statutes are found in Ariz. Rev. Stat. §§34-221, 41-2576, 41-2577, and 28.6924. The deadline for payments made from the public entity to the prime contractor depend on whether it is a progress or final payment.

Payment Deadlines For Public Projects

For progress payments, once a prime contractor has submitted a proper payment request the contracting public entity the request must be approved or denied within 7 days. After the invoice has been approved, the entity has 14 days to make payment. As for final payments, these are due within 60 days of final acceptance of the project as a whole. Upon receipt of payment, the prime contractor will have 7 days to make payment to their subs and suppliers. However, this timeframe can be modified by the terms of the contract.

Penalties For Late Payment On Public Projects

Again, there are certain circumstances where payment can be withheld. But if none of these reasons apply, any late or wrongfully withheld payments will be subject to an interest rate at 1% per month. Also, if the dispute goes to court or arbitration, attorney fees and costs will be awarded to the prevailing party.