The construction industry has a payment problem. While not surprising to construction businesses, the extent of the payment difficulties encountered on projects can be surprising to those from other industries. The razor-thin margins, complicated payment structure, high failure rates, hidden parties, and confusing and unfair contractual clauses all combine to create havoc for parties on both ends of the payment chain.

But, what if this construction payment mess could be solved? What if construction payment could be fair to all parties? What if construction payment could be streamlined, optimized, and managed to reduce risk to all parties?

If all of that could happen, it would be the Construction Payment Utopia – and, believe it or not, it’s not as big of a pipe dream as you think. Current and developing technology can and will ease many of the construction payment pain points, and get within shouting distance of creating the utopia outlined above. How? Follow me down the rabbit hole and explore a world in which construction payment problems are a thing of the past.

The Problems With Construction Payment

In order to intelligently discuss what happens in a perfect construction payment world, the challenges of the current set-up should be examined so we know what can be changed, and what can’t, and how that which cannot be changed can be managed or optimized.

Construction Payment Works on Credit

The construction payment scheme is heavily reliant on credit. Nearly all construction industry participants furnish labor and/or materials on credit to some extent. Rather than requiring payment prior to delivery, most construction companies do the work or deliver the materials and then wait for payment. Because the value of the labor and/or materials furnished can be quite substantial, the need to float this cost can detrimentally affect cash flow and even solvency.

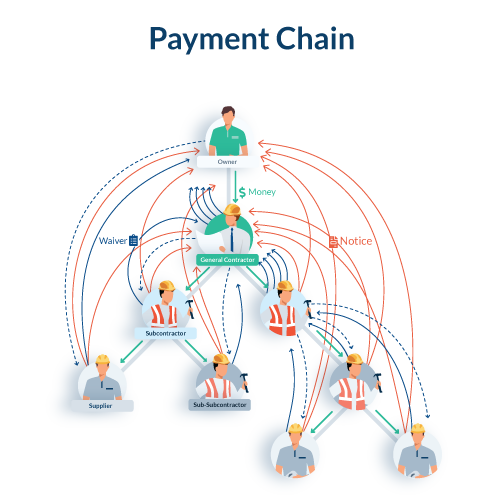

This credit-based approach extends throughout the payment chain; many companies both extend credit, and need a line of credit of their own. In many cases, a company’s own bills cannot be paid until payment is received from parties higher on the contracting chain. Because companies must wait for money from the top of the contracting chain, the further down-the-chain a project participant is, the more opportunities there are for that party to experience hiccups or abuses in the payment process.

And correspondingly, these stresses on lower-tiered parties create difficulties and risk for the top, as well. There are plenty of places on construction projects for money to slip through the cracks, and many reasons why payment can get delayed. Because of the interconnected nature of construction payment, any little inconvenience, delay, or dispute about any component of the work can impact payment for everyone on the project, whether or not that party was directly involved – both up and down the payment chain.

Further, this payment environment can force companies to make difficult choices regarding which invoices to pay on time. If a party is forced to wait for its own payment, that company may not have enough ready cash to float the invoices received from parties below.

The fact that there are problems with the construction payment process in general, both in managing payments and in getting paid, is something on which all construction industry participants can agree. However, the “top-of-chain” parties and “bottom-of-chain” parties have specific, and differing, views about the problems, abuses, and frustrations of construction payment. In fact, distrust or apprehension is a fundamental stumbling block to a clear, fair, and optimized payment process – and these feelings are exacerbated by misunderstandings inherent to the current system.

Lower Tier: The View from Below

Lower-tiered parties on a construction project (parties lower on the payment chain), are dependent upon money passing through the hands of the parties above them prior to payment. When this is coupled with delayed, or nonexistent, payment, the blame immediately goes to the top-of-chain parties. It’s no surprise that these parties routinely worry about payment abuses, risk-shifting, and other unfair payment practices keeping them from getting paid.

It’s inarguable that the higher up on the contracting chain a party can be found, the more leverage that party can exert over the payment process. The closer a party is to the money, the more control that party has. And similarly, the fewer steps the money has to pass through before a party gets paid, the fewer chances there are for the money to get stuck.

Since 1) the top-of-the chain parties are able to exert the leverage of payment against the lower-tiered parties, and 2) nobody wants to bear financial risk when it can be avoided, the top of the contracting chain has used the leverage provided by their position to create risk-shifting mechanisms to push the financial risk onto the lower-tiered parties.

Accordingly, this results in resentment and distrust from the lower-tiered parties. In many situations, lower-tiered parties believe that the higher tiered parties have “rigged the game” such that a project’s financial risk is pushed completely down-the-chain.

No-lien clauses, pay-when-paid/pay-if-paid clauses, ultra-strict noticing provisions, over-broad lien waivers, and more have been used to limit financial risk, with varying success. These practices are viewed with disfavor by lower-tiered parties, and oftentimes, their use plays into the narrative that the problems in construction payment come from above. The “GC-as-Bully-dangling-payment-over-the-heads-of-their-subs” view has some relevance, especially to lower-tiered parties struggling to get paid fairly, and on time.

There are also significant difficulties with the process when viewed from the top, however.

Top-of-Chain: The View from Above

The top-of-chain parties are not without their own financial risks and difficulties. Chief among these difficulties is the problem of visibility, and the associated financial risk of liens (and lien abuses) from unknown parties. After all, a GC can’t make sure a supplier is paid if the GC has no idea who that particular supplier is, or that he or she was even on the project.

Far from the payment abuse this lack of payment may be viewed as by the unpaid party, it may be as simple as the fact that the party with the money doesn’t know the unpaid party hasn’t been paid. Because construction projects routinely have numerous parties unknown to the parties with control of the money, the top-of-chain parties are worried about the risk of double-payment or stoppages in work caused by lower-tiered parties’ usage of lien or bond claim rights, whether or not warranted.

Use of the security rights afforded to lower-tiered parties flips the financial risk, but this ability to flip the risk and throw a wrench in the works of a project may not be dependent on the fault of the higher-tiered party (or even pursuant to an actual lien right).

Along with the necessity of managing lien exposure (and protecting against unwarranted lien exposure), the top-of-chain parties also placed in a position of managing parties they generally view to be less financially sophisticated. When viewed in this manner, the liberal usage of lien waivers for payments made down the chain is less predatory (when used appropriately) and more good business sense. While lower-tiered parties have a significant and appropriate objective to get paid – the top-of-chain parties have an equal interest in making sure they are not required to pay more than once for the same work.

Despite these misaligned interests, the distinct possibility of distrust, and unequal bargaining power, construction payment remains, at least to some extent, on relationships. If that is true there must be some common ground, and the potential to optimize the process to the benefit of each side of the payment chain.

Creating a New Construction Payment Utopia

So, how can this problem be fixed? How can construction payment be made fair? It’s impossible to remove risk from the picture completely, and it’s likely impossible to create a completely even distribution of risk throughout project tiers.

It is possible to create a fair system, and a system in which each party knows the exact nature and extent of the risk, and is not forced to accept more than their share.

The construction payment utopia must, in a fundamental sense, be transparent and based on maintaining and growing relationships through fairness.

In order to eliminate the vast majority of payment problems in the construction industry, there has to be buy-in from all tiers of the payment chain – something that so far has remained elusive. Despite the elusiveness of full-chain buy-in, systems and processes already exist that can move the industry in this direction. While a “perfect” payment system is likely a pipe-dream, “near-perfect” payment can be accomplished. And, as compared to the current view of the construction payment system, a “near-perfect” system would be a utopian vision.

Step 1: Send Notices to Increase Visibility & Security

If a fix to the construction payment problem must be based on fairness and transparency, visibility (both of participants, and of those participants’ rights) is key. In a perfect world, every party on a construction project would be known to the GC (or party in charge of the money), along with the parties’ payment and security status. Fortunately, this can be accomplished in a manner that benefits both sides of the payment chain.

Visibility can be promoted by lower-tiered parties sending notices to the higher-tiered parties. Sending notices both protects the lower-tiered parties security rights, and provides upper-tiered parties with the ability to know and track the project’s participants and those participants’ security status. The ability to track all project participants allows the upper-tiered parties to manage exposure by providing a made-to-order checklist of parties from whom lien waivers may be needed upon payment to a sub, and exert control over the payment process. This visibility also benefits the lower-tiered parties by allowing the GC to view the parties that need to receive payment.

Read more: The Ultimate Guide to Preliminary Notice

This first step provides the foundation for a better construction payment process. The top knows the identity of all project participants, and all project participants are protected by the security built into the law for that purpose. Everybody retains some control, and the process has begun to become more fair.

Step 2: Use Waivers to Create Transparency and Optimization

The second step in creating the construction payment utopia requires an adoption of technology, and a shift in understanding. The potential lack of payment is only one problem in the context of construction payment as a whole; slow payment is equally troublesome. Due to misunderstandings, lien waivers reside at the center of the slow-payment roadblock, and mismanagement of these documents can be enormously detrimental to companies on both sides of the payment chain. Optimizing the lien waiver process can fundamentally change the speed of payments, provide protection to every party, and promote transparency and fairness in the construction payment process.

The needs of the lower-tiered parties (getting paid quickly), and the needs of the upper-tiered parties (keeping the project free of lien claims and avoiding double payment) intersect at the lien waiver document. Despite this, however, lien waivers are misunderstood, and the lien waiver exchange process is flawed and sub-optimal.

Given the high stakes, and the legal free-for-all regarding lien waivers, it’s no surprise that problems arise. Using incorrect/not legally sufficient forms, waiving more than contemplated, and signing an over-reaching waiver for the promise of payment can all seriously impact the payment process. Many of these issues, however, can be eliminated by proper understanding and the use of technology.

When fair and correct lien waivers are used in an intelligent manner, all parties benefit. Lower-tier parties gain faster payment and the knowledge that they are not waiving anything other than that which they intend to waive, and upper-tier parties gain legally sufficient waivers from every party immediately upon payment to protect against potential lien claims and double payment. It’s a win-win.

Construction Payment Utopia Needs Better Technology

In order for this result to be reached, however, parties must adopt technology able to create this result. Conditional waivers (conditioned upon the actual payment) should be sent by every party along with every pay-app or invoice as a matter of course.

This seems a stretch, but since the waiver would be conditional, nothing is actually waived unless payment occurs. When that payment does occur, an unconditional lien waiver should be immediately generated and sent. The result: faster payment, less lien exposure.

By using the “conditional waiver” instrument, parties can avoid the hassle and wasted time of using an escrow-type solution. This solution promotes fairness, transparency, and relationships in the payment process, as opposed to the mistrust upon which the escrow solution is founded. When each party understands that it is not necessary to hold a (conditional) waiver back until payment is actually made, and that an (unconditional) waiver is not something that must be forcefully demanded and obtained prior to payment the system just works better.

While true construction payment utopia is a challenging prospect, new technology, and a slight shift in understanding can create a fair, transparent, and streamlined payment system that best protects everybody’s interests. I think that’s a win.